You can fight fire with fire – but can you fight Statist Incrementalism, with more Incrementalism?11/30/2015 We can all thank Ron Paul for his relentless efforts to bring awareness to the American people, that our Federal Reserve System and their Marxist fiat monetary model are inherently corrupt. Indeed, every one of our nation’s socio-economic ills can be traced back to this institution’s deliberate manipulation of our money – which is the very foundation of our entire economy. Many have also finally figured out that this cancerous partnership between our government and The Fed has been foisted upon the American people in a long-term, systematic, surreptitious process of incrementalism, mainly because its very existence is unconstitutional.

Fortunately, there are a few who see it for what it is and understand that this system must be dismantled and Sound Money restored. In fact, more are becoming aware that this is indeed the ONLY means by which to restore real property rights for all Americans and bring real liberty back to the American people. Chief among those who both understand this and are currently embroiled in the Republican Primaries, are Rand Paul and Ted Cruz. What is interesting is their different approaches to this problem. It’s now clear, at least to this author, that the Rand Paul strategy is to try to use incrementalism as the means to bring about a slow dismantling of the Fed. This strategy seems to have been passed down from his father (who spearheaded at least 4 prior House Bills to audit the fed - all of which passed, but then amounted to nothing). Every few years for the past 20, I have seen some new incarnation of a Ron Paul “Audit the Fed” bill introduced to Congress, and then come to a vote with much fanfare. Most recently, just prior to the senior Dr. Paul’s retirement from Congress, two companion bills were introduced simultaneously in the House and Senate, by the father-and-son duo of Ron and Rand Paul respectively. Ultimately, after the house-bill passed yet again (for the 3rd consecutive time) the Senate version stalled in Committee for more than 3 years under orders from corrupt Democrat Harry Reid – again to no avail. As much as I admire and support both Dr.’s Paul, I have to ask myself; why do they continue to bother with the incremental approach? Is it because it required this incremental strategy to get the Fed system shoved down our throats in the first place ? It took at least 3 or 4 generations since 1913—for the Marxist foundations of our fiat monetary system, our system of progressive taxes on income, property taxation, etc. – to take root in America before their effects were widely noticed (while continuing to falsely proclaim our country as “free-enterprise capitalism”). This incrementalism coupled with the false-flag tactic of blaming our consequent and mounting econonmic problems on the “Capitalism” they had already abandoned is how the leftists since Wilson and later FDR, were able to get away with implementing Socialism in America --without anyone noticing. The question I now must ask is this: Is this same strategy of incrementalism is the best way to “un-do” these insidious and corrupt Marxist institutions such as “The Fed,” the IRS, and others? After watching things unfold over these past 20+ years -- I've come to a different thought process on this. As much as I admire and respect Ron Paul, and his son Rand as well -- there is an old saying that goes something like this: "the definition of insanity - is doing the same thing over and over and expecting different results." This push to audit the fed is nothing new. The only thing it has accomplished (other than to “raise awareness”), is to have wasted tens of thousands of billable hours of time for legislators and their lawyers, while having brought ZERO accountability to the Fed. Continuing to take an incremental approach toward putting the Fed into line is not only a waste of time at this point; but it plays directly into the hands of those who control the Fed. All they do is laugh at these efforts, and continue to use their lapdog media to try to paint people like Ron and Rand Paul and other anti-Fed people as a bunch of tin-foil hat wearing extremists. After-all, if even the Pauls are willing to "incrementalize" something that should clearly be abolished ---- one has to wonder whether the Pauls themselves believe in the efficacy of their own ideas. Like I said … incrementalism hasn't worked over the past 20 years, and doing the same thing while expecting different results … well, you know the rest. My view is this: let's stop pussy-footing around and finally just open this can of worms so that the American people stop being misled to the idea that the Fed should remain intact—but be "reformed" or "modified" in some way. That is absolute NONSENSE. The only way to restore real property rights and liberty for all Americans, is to restore Sound Money. That means money in accordance with Article 1 of the Constitution---which means, a precious-metal based commodity standard. That means --- No Federal Reserve in ANY form. Article 1 – Section 8: “The Congress shall have the power … to coin money, regulate the value thereof, and of foreign coin, and fix the standard of weights and measures; to provide for the punishment of counterfeiting the securities and current coin of the United States; …” The Constitution further prohibits the US Congress from delegating any of its powers to another party. As such, the Federal Reserve Act has been in violation of this provision since the very beginning, so it’s time for Congress to make this right again, once and for all. The US Dollar must be based on a fixed standard of a precious metal, its value and volume determined only by Congress, and therefore created only by the US Treasury. No middle-man, no debt. Read that again – NO DEBT. This means No Fed. Not a "quasi-Fed" ... or a Fed that has been audited, or Fed that has been audited and then "incrementally" stepped toward a "new fiat money with more constraints." None of that is acceptable. We need to RESTORE THE CONSTITUTION – NOW – before it becomes a completely irrelevant letter. Incrementalism at this stage of the game only gives those in charge of the Fed time to continue their shenanigans and thus continue to sabotage the process of restoring our country’s bases for Constitutional authority. We need SOUND MONEY.....nothing short of that will do. So let's grow a spine, state the truth, educate the people on this...and be done with it. To drive this point home, here is an Excerpt from the book Chase The Rabbit: Ending the Federal Reserve System: There are two ways to end the Federal Reserve System. It can either be done in a single bold legislative act, or it could be dismantled incrementally by transitioning the system toward that goal. Either way has certain pros and cons. As far as this author is concerned, I believe that this system must be dismantled as soon and as quickly as possible so that the corrupt, self-serving members of the Federal Reserve system will not be in a position to sabotage the process of restoring sound money—for they have every reason to do so. Restoring the Gold Standard Some authors have suggested that the Federal Reserve system could be reformed, in order to restore some stability while allowing the fiat system to continue. Those making these proposals are well intentioned, and they believe that taking such steps will set the stage for an incremental dismantling of the Fed. Incrementalism however is a counterproductive strategy in my opinion. I therefore disagree with these approaches and will explain why under each of their proposed tactics below: Change the Mandate of the Federal Reserve According the Federal Reserve’s website, “The Congress established the statutory objectives for monetary policy in the Federal Reserve Act as being: maximum employment, stable prices, and moderate long-term interest rates.” The Federal Reserve’s actions during the past hundred years reveal that they are far more interested in achieving the opposite. They willfully create targeted "market-specific" inflations (economic bubbles) and enact policy that maximizes unemployment in order to ensure that the corporations owned by their banking cartel have a desperate and underemployed workforce ready and willing to work for peanuts. If they haven’t fulfilled their existing mandate at any time in the past hundred years, what difference would it make to change their mandate now? Adopting a Formal Rule to Guide Federal Reserve Decision-Making The Fed has had formal rules intended to guide their decision-making process since it was founded. They have not followed those rules, and as Mr. Greenspan and Mr. Bernanke have told Congress on numerous occasions, they are not obligated to disclose the details of their actions and are not accountable to anyone. In fact, they have deliberately prohibited Congress any scrutiny of their adherence to those rules. It is for this reason that for the past thirty years former congressman Dr. Ron Paul has worked tirelessly to bring transparency and accountability to the secretive Fed. In 2009 and 2010 he introduced: HR 1207, the bill to audit the Federal Reserve. The bill passed as an amendment in the House’s Financial Services Committee and in the House itself. But eventually the most significant portions of the bill were derailed. Dr. Paul reintroduced Audit the Fed on January 26, 2011 as HR 459 along with a companion bill introduced by his son, Dr. Rand Paul, in the Senate as S202. Exactly eighteen months later on July 25, 2012, the House of Representatives overwhelmingly approved the Texas Republican’s bill with bipartisan support, and it passed 327–98. The Senate version of the bill, S202, however, has remained stuck in the US Senate Committee on Banking, Housing, and Urban Affairs, as Chairman Tim Johnson (D-SD) is under direct orders from Senate majority leader Harry Reid (D-NV) “not to let it out of committee.” As of this writing, this bill has remained stuck in the Senate committee on Senator Reid’s orders for more than two and a half years. For a US Senator to deliberately quash a legitimate bill from being voted upon by the Senate—a bill that has passed the House of Representatives twice—is a blatant violation of his oath of office and his obligation to his constituency. If the other US Senators were true to their own oaths of office, they would immediately act to remove Senator Reid from his position for his repeated and egregious violations of the public trust. Clearly the corruption has extended from the Federal Reserve banking cartel and into the halls of Congress. What good is a set of rules for decisions for either the Federal Reserve or the US Senate when the top-ranking members of both institutions willfully violate them? Clearly, Senator Reid’s relationship with the Fed should be investigated for possible conflicts of interest. If such conflicts are proven, it would render him as incapable of continuing in his duties as a US Senator, and he should in that case be removed from office immediately. Adopting a Full Gold Standard by Establishing an Official Gold Convertibility Rate for the Dollar This is essentially restoring the system back to the pre-FDR structure. This is probably the best suggestion by those trying to keep the Federal Reserve system in some form, but as FDR proved, as long as the Fed system exists in any form whatsoever, the means to corrupt our monetary system will continue to exist as well. As long as a private banking cartel controls the nation’s money supply, whether on a gold standard or not, we will forever be fighting the thieves who are bent on robbing us of our property rights. We must remove the wolves from the hen house once and for all. Allow Competitive Currencies, Including Private Currencies Backed by Gold or Silver, to Circulate against Federal Reserve Notes Friedrich Hayek, the Austrian economist who won the 1974 Nobel Prize in economics had written extensively on his mistrust of any government to maintain even an honest gold standard. In November 1977, Hayek asserted, “I am more convinced than ever, that if we ever again are going to have sound money, it will not come from government; it will be issued by private enterprise.” This form of monetary system is the model that is truest to the principles of a free-market economy. It represents the most honest monetary standard and should be held up as the ultimate goal for our monetary system. The most likely to be achievable step in this direction will be to end the Federal Reserve System and restore the gold standard with our Congress-controlled Treasury in control of our money, while allowing competitive currencies to come into being based upon market demand. … End of Excerpt Having watched the last two Republican primary debates, something struck me which began to differentiate Ted Cruz, from the rest of the candidates. First as a disclaimer, I must clarify that this is not to make any kind of endorsement; this is just my commentary on a strict observation of the events. In fact, until now; I have been for many years a Ron Paul supporter. Who I am currently in favor of for President I won't say in this article, because I haven't yet made up my mind. Nevertheless, during the 3rd GOP debate on CNN, it was Ted Cruz who finally had the guts to mention restoring SOUND MONEY based on Gold, as the basis for restoring American principles to our governance. I applaud him for that. I can’t speak for others, but to me, this comment raised the question in my mind; “Is Ted Cruz the only candidate with the knowledge, the backbone, and above all, the courage, to do what is necessary to finally dismantle the Federal Reserve System and restore a true Free-Enterprise Capitalist economy in America?" What has surprised me most, is that Rand Paul has been nearly silent on the issues of sound money and property rights - while these are the cornerstones of a free and just nation. This election is about restoring liberty, individual sovereignty, property rights, and Constitutional authority. As such--at this point--incrementalism be damned. Stop beating around the bush. The Federal-Reserve is a seven-headed fire-breathing dragon, bent on consuming the fruits of labor of every man and woman in America. You really think poking it with a finger is going to make it get in line? We the people need to decapitate this beast as quickly and as soon as possible, so that we can take back our property, the fruits of our labor, our homes, our families, and our very lives ... and time is running out.

3 Comments

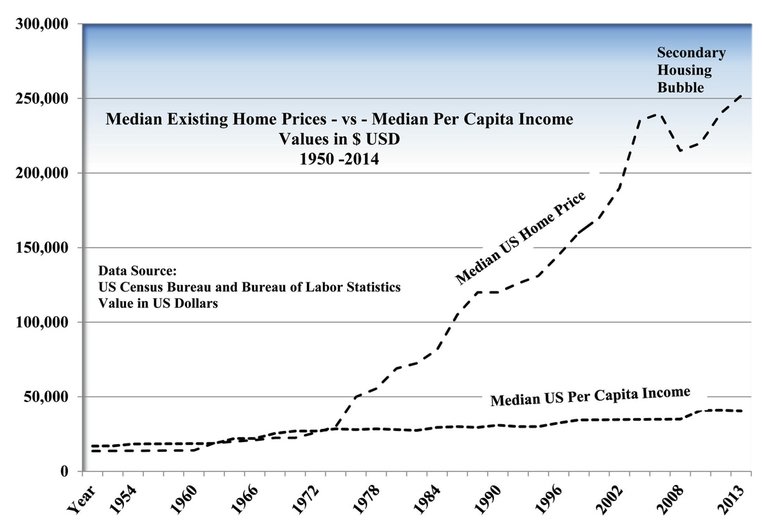

The main distinction between a free-enterprise capitalist system, and its opposite (Socialism, Communism, etc.), has to do with property rights. In a free society individual citizens have the right to property ownership. In a collectivist society (Socialism, Communism, Fascism) – only the collective owns and/or controls all property (including labor) – and then “distributes” wealth as the ruling class of that society sees fit. This is only logical. Under free enterprise capitalism –where individual actors are free to transact with one another voluntarily and by mutual consent—those actors can only trade or sell that which they own. You can’t just sell your neighbor’s property or conscript their labor without their consent. The former is theft, and the latter slavery. But history has demonstrated that Socialist governments both steal and enslave. Therefore, for a government to “redistribute wealth” under any form of socialism – that government must eradicate individual property rights. This distinction seems to escape most people. To state this principle more simply, a free enterprise economic system requires a respect for individual property rights; a socialist economic system requires there be no individual property rights. The Back Story - The Money All property — whether we’re talking about your land, your home, or your labor— has a value. That value is measured in terms of the monetary system over which that economy functions. There are only two kinds of money – Fiat money, and Sound money. Sound money (under a precious metal standard such as gold or silver) protects your property rights, because it has intrinsic value, so its purchasing power is stable and the resultant value of your property (and of your labor) is determined solely by the individual actors in the free market – qua - supply and demand. Fiat money on the other hand is created as debt. Every unit of fiat money created, is owed back to the issuer (the central bank) — plus interest. As such, under a fiat monetary system, all of your property (and your labor) that is valued in terms of that fiat money – is actually controlled by the issuer (lender -- through inflation and interest rate manipulation). Under an inflationary Fiat money system, supply and demand is deliberately distorted, surreptitiously giving the issuer control over the value and disposition of your labor and your property. These economic distortions are evidenced by the many “market-specific inflations” (such as the housing bubble for example), which have been deliberately foisted upon the middle class as means to destroy home-ownership—while at the same time—when coupled with unfair taxation on labor compensation – surreptitiously conscripts individual labor. Many Americans believe that it was Richard Nixon who took the US Dollar "off the gold standard" in 1971, when he rescinded the Bretton-Woods Agreement. This is not entirely accurate. It was in 1933, when FDR took the US Dollar off of the “gold standard,” that our currency was converted from Sound money - “United States Dollars” into Fiat money - “Federal Reserve Notes.” From that time until 1971, the US dollar was on what was known as "The Gold Exchange Standard." Explaining that is beyond the scope of this article. Nevertheless, all the reader needs to know is that since 1933 – our government and their corrupt partners in the Federal Reserve System have printed fake money, expanding the “money supply” to astronomical proportions. This is what is called “inflation.” Most people believe that inflation is "caused" by rising prices but this understanding reverses cause and effect. In truth, the word “inflation” denotes “inflating” or expanding the supply of money. This causes every existing unit of money to be diluted in terms of its purchasing power. The consequence is that it takes more money units to buy the same goods or services as before – giving the appearance of rising prices. Inflation is created deliberately, by the central bank's monetary policy decisions. The goods and services you’re purchasing are the same. Their intrinsic value has not changed. If you’ve lived in the same home for the past 10 years –it’s the same home—it hasn’t changed in terms of its utility or REAL value to you. But its price may have doubled in that time. This reveals that under our fiat monetary system – price and value are not the same thing. Price is always manipulated and perverted under fiat money. What is more insidious, is that the magnitude of inflation can be differentially applied across markets. In other words, through market-specific interest rate manipulation by banks - prices for homes, food, and other necessities can be inflated at a different rate than say - the labor market. And that is exactly what we have seen over the past 50 years, as the graph above so clearly illustrates. Nevertheless, "we the people" are industrious. Even if most don't understand the underhanded tricks and machinations our ruling class uses to try to enslave us, it is in our DNA to try to create and accumulate wealth for ourselves and for our children. But the ruling class doesn't want you to create and accumulate wealth for yourself or your children. They want you to create it for them. And they want it ALL. They want your property, your money, your labor, and control of your very life. They are very - very - patient. This is why they surreptitiously took control of "the money supply" in 1933. But their greed knows no bounds, and the fact that we the people can still use cash without the rulers ALWAYS taking a cut from EVERY transaction - is thorn in their side. They're not happy with you having at least some of our former freedoms. Our ruling class is populated with control freaks - mentally ill to the core. They don't want you to have ANY freedoms whatsoever. Here is how they intend to remove that thorn: In spite of the fact that the US Federal Reserve Note has lost 98% of its purchasing power since 1933, banks are still required to act with at least some minimal level of discipline. They are still somewhat restricted in their fraudulent fractional-reserve lending practices – due to the reserve requirement to which they are subject. This means that all commercial banks in America are obligated to keep at least 10% of their depositors’ cash on-hand (so they can only “loan out” 90% of their depositors’ money). This is in order that if some depositors come to take out some of their cash – the bank will have some available to return to depositors. Given this understanding, “we the people” should now be asking ourselves this question: “Why over the past few years, have we begun to witness the emergence of a war on cash?” The Cashless Society As with every other insidious Socialist policy and institution that has surreptitiously infiltrated the US economy over the past 100 years, we have been hearing more and more propaganda touting a movement to eliminate cash-money altogether – and move us toward a “cashless society.” The first thing the reader must understand – is that the only REAL cash – is Sound money. Fiat money is not cash – it is counterfeit. Second, all of the economic ills our country has faced over the past few generations are a direct consequence of the dysfunctions that occur under a Fiat monetary model (which is a fundamentally Marxist construct). So why would those with power over our system (which has been deliberately misrepresented as “free enterprise capitalism”) want to go to a cashless society? You can count on being indoctrinated by the mainstream media that this would be for your benefit. But as with all things that have been shoved down our throats by our government, you can bet it is for the opposite purpose. What will be the consequences? It will mean a permanent end to individual property rights, and the final nail in the coffin of the free-enterprise system upon which America was founded. America abandoned sound money, and with it real Free Enterprise Capitalism a century ago. However, there still exists the possibility to restore Free Markets and The Constitution. Moving to a cashless society, however, will make this impossible. The clandestine and incremental slide toward centrally controlled Socialist-Fascism will be complete, and irreversible. Read that sentence again and let it sink in. Unless you want your children, grandchildren, and every generation thereafter to suffer immeasurably — a life of perpetual inescapable servitude — under the thumb of a small group of Narcissistic, Sociopathic, Power-Mongering, Socialist Control Freaks -- you must resist the cashless society with every fiber of your being. There are several reasons for this. With the growth of the surveillance-based police state, imagine for a moment the consequences of being deprived of any anonymity whatsoever, for every transaction no matter how seemingly insignificant. Without cash, you will have no choice but to involve a “financial institution” to process all of your electronic transactions. Never again will you be able to sell your used television to your neighbor without government interference. Just conducting a garage sale will require you to first obtain permission from the government as well as access to a bank’s electronic transfer services — for a fee of course. You will not be able to buy a stick of gum without paying a transaction fee for doing so. Every transaction you make will be recorded electronically and data-mined for your preferences, your lifestyle, your whereabouts at any moment, and your every decision. The transaction fees you pay will cover the government’s cost of controlling you. This is the concept of “feeding the beast”—on steroids. The information that will be available to governments when no one can buy or sell anything without going through a bank is big government’s dream come true. Imagine ordering a pizza and bottle of Coke to be delivered to your home. Three minutes after your order has been delivered and your e-money account has been debited, you receive a phone call from your health-insurance provider. The premiums you pay for this health policy are deducted from your wages automatically — without your consent — since you are obligated by law to have this “insurance”. A pleasant electronically generated female voice on the other end says, “Mr. Smith, the pizza and soda you are about to consume have been proven to be a leading cause of heart-disease. Since your most recent quarterly health screening showed elevated triglycerides and HDL cholesterol, you must be advised that your health insurance premiums will be raised by 7.5%. For your convenience, this will automatically be deducted from your account on the next business day. Have a nice day and enjoy your pizza.” This is not hyperbole. This kind of blackmail via data-mining is already being practiced by insurance providers of all kinds. And this scenario is only the tip of the iceberg. An even greater threat that will be imposed by the cashless society is relatively unknown to most Americans — even the ones who are paying attention. Consider the fact that banks today are forced to have at least some modicum discipline in their lending policy due to the requirement they hold 10% of their depositors’ cash in reserve as physical cash. Most people understand the concept that a “run on the banks” occurs when all depositors try to withdraw their money at the same time, and the bank lacks enough physical cash to satisfy its liabilities. When physical money no longer exists, the reserve requirement becomes irrelevant since there will no longer be any real money to put on reserve. There can be no risk of a bank run when there is nothing at the bank to run after. In fact, no one will “withdraw money” ever again. Every transaction you make will be “processed” electronically by a computer. Banks will merely create as much electronic money as they need to satisfy the demands of their “depositors” as well as borrowers. With no reserve requirement, banks will be absolved of any fiscal discipline whatsoever. They will then also be absolved of paying any interest to depositors. Negative interest rates on deposits will become the norm. In other words, you will pay the bank for the privilege of managing your electronic deposits rather than the bank paying you interest for holding and re-lending your money. Banks can then write loans to all comers and expand the money supply to infinity. All it will take is a few keystrokes on a computer keyboard. Hyperinflation will be the result. Unintended Consequences (or intended perhaps?) Restrictions on transactions that will come into effect will be disguised as benefits of the cashless society. Parents will be lured into embracing the notion that their 17 year old will be unable to buy liquor using a fake ID, since their smart phone, or perhaps worse – the chip implanted in their wrist – will be programmed to prohibit them from buying any. In fact, the ruling class will be able to program your card or chip with whatever transactional restrictions they like, without having to pass a law to do so. The technology is already there to modify your purchasing restrictions anytime the rulers see fit. Did you write a “letter to the editor” criticizing your State Governor for his recent transgressions with a high-school cheerleader? You may find that your unfavorable commentary about a political official has led to your chip being disabled for purchasing your weekly insulin supply, until you print a retraction and apology. If your electronic “fed-coin,” smart phone, or chip is not programmed to let you buy a certain thing, how will you get it? You don’t have cash anymore and no one would accept it if you did. In that case, you can forget about the 2nd Amendment. Gun registration will be unnecessary, since the leftists in charge of the banking aristocracy will disable any transaction for a firearm from ever being able to take place. As always, criminals will still easily obtain guns and drugs through illegal barter, but you won’t – since you’re not a criminal. The cashless society will be sold to the American people as a “convenience,” as a “more secure form of payment,” as your patriotic duty, or as some other nonsense. Conditioning The People for Slavery This is one of the little known reasons for having had artificially low interest rates for such an extended period of time. The financial “industry” has done this partly to allow normalcy bias to set in on the current generation. They have been conditioning people with the idea that being paid nothing in interest for your “savings” deposits should be normal. Once they move to negative interest rates — paying the bank interest and fees to “manage your deposits” — few people will object and many might not even notice. In February, 2016, the makers of the classic board game Monopoly announced that the game will no longer feature paper cash. Players will instead have an electronic “bank card,” like a debit card. The process of using games like this to condition children and youth with the idea that cash is “antiquated” is already underway, not only in board games, but even in school. Most public school lunch programs have now disallowed the use of cash for children to buy their lunches. Unwitting parents see this as convenient and safer. However, children are being inculcated starting in the first grade that a swipe card is the same as money. By the time they are adults, they won’t even know how to count change for a cash purchase. The outcome of the cashless society will be unrestrained hyperinflation and a rapid expansion of poverty. Just trying to feed your children and keep a roof over their heads will constitute “living beyond your means.” The new normal will mean that the most basic standard of living will be unaffordable without using a vast amount of debt. If you want to try to start your own small business – one that may compete against some bank-controlled corporate behemoth – forget it. You, your children, grandchildren — every successive generation — will be forced into employment and debt servitude from the time you are able to work for your first electronic nickel, until you’re too old and decrepit to walk to the toilet by yourself. By the end of your life, you’ll have no real assets of any kind. It will mark the permanent end of individual property rights—forever. You will never be able to object to this system once it’s been put in place. If you exercise your first amendment right to free speech by saying something the government (or the bank) doesn’t like — you will likely find yourself deprived of the ability to conduct any transaction at all. In fact, once this economic catastrophe has been shoved down our throats — the Constitution and Bill of Rights will become completely irrelevant artifacts. Once the cashless society has been fully implemented—it will be impossible to reverse it and restore sound money—as the Constitution requires. The end result — Miserable, Abject, Global Slavery. This isn’t some hypothetical futuristic conspiracy theory. It is a conspiracy fact – and it is already being implemented right now. It’s important that the American people understand the grave implications of this “last-straw” in the long and surreptitious eradication of our property rights. Consider the fact that there is not a single mention of this (or of property rights in general) by any political candidate who sought elected office during this most recent current election cycle. There is a reason that these facts are being ignored by the media, and obscured from the public. Implementing The Cashless Society Is Secretly Underway All over the world, it is starting with subtle capital controls being enacted by government agencies and commercial banks, as well as through changes to the currency system. For example, in the US city of New Orleans, the local government decided to stop accepting cash payments from drivers at the Office of Motor Vehicles. Several branches of Citibank in Australia have stopped dealing in cash altogether. India recently demonetized its two largest denominations of cash, leaving the entire country in economic chaos. A few weeks later, former US Treasury Secretary Larry Summers published an article stating that “nothing in the Indian experience gives us pause in recommending that no more large notes be created in the United States, Europe, and around the world.” Summers has long advocated for putting an end to the $100 bill. JP Morgan Chase, the largest bank in the U.S., has recently enacted a policy restricting the use of cash in selected markets. Chase has banned cash payments for credit cards, mortgages, and auto loans; and they have disallowed the storage of “any cash or coins” in safe deposit boxes. The war on property rights has moved from one of words—to a war of actions. Here are several recent and very alarming quotes that should chill any individual who cherishes his or her freedom and anonymity: 1. “Despite advances in transaction technologies, paper currency still constitutes a notable percentage of the money supply in most countries… Yet, it has important drawbacks. First, it can help facilitate activity in the underground (tax-evading) and illegal economy. Second, its existence creates the artifact of the zero bound on the nominal interest rate.” -- Kenneth Rogoff (from the intro to his paper The Costs and Benefits to Phasing Out Paper Currency) In other words, cash (not money) is the source of all evil and must be destroyed because governments can’t trace its every movement, and it represents a limiting factor on central banks’ ability to continue their insane negative-interest-rate experiment. 2. “This cost has to be seen against the cost that the anonymity of currency presents to society. Even though hard evidence is hard to come by, it is very likely that the underground economy and the criminal community are among the heaviest users of currency. This, I believe, is the hidden intent behind all the excited talk about banning cash: to do away with the personal anonymity it offers.” -- Citigroup‘s Chief Economist Willem Buiter 3. In the wake of the Charlie Hebdo murders, France‘s finance minister Michel Sapin started scare-mongering by blaming the attacks on the assailants’ ability to buy dangerous things with cash. Shortly thereafter he announced the implementation of capital controls that included a €1,000 cap on cash payments, down from €3,000. He claimed that such radical measures were necessary to “fight against the use of cash and anonymity in the French economy.” 4. In his article: “The Great Advantage of a Cashless World,” Guillermo de la Dehesa,a Spanish economist, and current international advisor to Banco Santander and of course -- Goldman Sachs, writes: “Without cash, we would live in a much safer, less violent world with enhanced social cohesion, since the major incentive fueling all illegal activity [i.e. cash]… would disappear.” Dehesa also lamented that political authorities in all countries were incapable of taking this “transcendental step” to build a “safer and fairer world, in which there will be a reduced need for public and private policing and fewer wars, terrorist attacks, and burglaries, and drugs could only be bought legally.” With this deliberately misleading claim, he ludicrously elevated cash (rather than sound money) as a major cause of war and a laundry list of other evils.” In fact, the opposite is true. The enormous scale of wars over the past century have only been made possible by the existence of fiat money. An economy based on sound money, could never afford to wage war on the scale we have seen over the past 100 years, because no country could then simply print money as debt – thereby conscripting the future labor of all of its citizens to pay for it. Dehesa’s comment reveals either a completely perverse understanding of economics, or a deliberate obfuscation of the truth – in order to usher in such a corrupt system. 5. Economist and former US Secretary of Labor Robert Reich, enthusiastically opined on a recent CBS news interview: “There will be a time – I don’t know when, I can’t give you a date – when physical money is just going to cease to exist.” 6. “Everyone thinks cash is so simple and so easy and so fast and so secure. It’s NONE of those things. It’s really expensive to move it, store it, secure it, inspect it, shred it, redesign it, re-supply it, and round and round we go!” --- David Wolman, author of The End of Money, in an interview with CBS on why he believes that cash is so impractical (not to mention unhygienic, or as he puts it “pretty gross”). 7. In the Bill and Melinda Gates Foundation’s 2015 annual letter: “The technologies are all in place; it’s just a question of getting us to use them so we can all benefit from a crimeless, privacy-free world. What better place to conduct a massive social experiment than sub-Saharan Africa, where NGOs and GOs (Government Organizations) are working hand-in-hand with banks and telecom companies to replace cash with mobile money alternatives? The letter goes on to explain: “Because there is strong demand for banking among the poor, and because the poor can in fact be a profitable customer base, entrepreneurs in developing countries are doing exciting work – some of which will “trickle up” to developed countries over time.” What the Foundation doesn’t mention is that it is heavily invested in many of Africa’s mobile-money initiatives and in 2010 teamed up with the World Bank to “improve financial data collection” among Africa’s poor. One also wonders how much Microsoft will one day profit from the Foundation’s front-line role in getting a piece of every transaction from the abject poor and destitute of these third-world countries. Every time an impoverished African woman manages to scrape up enough electronic credits to buy her baby a bottle of milk, Bill Gates will happily “earn” a 2% commission on her transaction – as will a few other parasites from government and international banking. 8. Citi -- a big player in the African arena -- recently launched a partnership with USAID aimed at accelerating mobile money adoption in developing countries. From their joint press release: Expanding the adoption of mobile financial solutions is a critical economic development strategy with the potential to drive growth and increase financial access and security for the developing world’s poor population. The effort seeks to strengthen alternatives to a cash-based system that is inefficient, costly, and prone to corruption. [Anything that allows individuals to conduct transactions without the parasites in government or banks being able to cut themselves in on the action – is considered “corrupt”] The move to a cashless society is clearly the end-game of the ruling class. The political and financial elites are now starting to put out all kinds of propaganda to try and lure the unwitting public to get on board with that agenda. They make false claims suggesting that large denomination bills are only used in criminal enterprise like the drug trade (ignoring the fact that crime data completely contradicts this assertion). As a result of technological advances and generational priorities, unless the hardworking people—not just of America, but of the entire world—actively object and lobby their politicians with a vocal rejection of this concept—cash’s days are numbered. The move to a cashless society is clearly the end-game of the ruling class. Don Quijones, editor of “Wolf St.” writes: “there is a whole world of difference between a natural death and euthanasia. It is now clear that an extremely powerful, albeit loose, alliance of governments, banks, central banks, large corporations, and NGOs are determined to pull the plug on cash — not for our benefit, but for theirs.” As Quijones warned in his article: We Are Sleepwalking Towards a Cashless Society, “we (or at least the vast majority of people in the vast majority of countries) are willing to entrust government and financial institutions – organizations that have already betrayed just about every possible notion of trust – with complete control over our every single daily transaction. And all for the sake of a few minor gains in convenience. The price we pay will be what remains of our individual freedom and privacy. By Don Quijones, Raging Bull-Shit. He went on to state correctly, yet ominously: “by far the biggest risk posed by digital alternatives to cash such as mobile money is the potential for massive concentration of financial power and the abuses and conflicts of interest that would almost certainly ensue. Naturally it goes without saying that most of the institutions that will rule the digital money space will be the very same institutions — institutions like HSBC — that have already broken pretty much every rule in the financial service rule book. They have manipulated virtually every market in existence; they have commodified and financialized pretty much every natural resource of value on this planet; and in the wake of the financial crisis which they almost single-handedly caused, they have extorted billions of dollars from the pockets of their own customers and trillions from hard-up taxpayers.” By the end of 2012, only about 8% of the total money supply existed as physical paper and coin. The recent years of “quantitative easing,” most of which was electronic money creation, has reduced this proportion even further. The looming danger to individual property rights is not just alarming for Americans, but for every industrialized nation on Earth. Governments and huge corporations have several things in common: they want to know everything you do, they want to take your labor and pay you little or nothing for it. They ultimately want to take everything you have ever worked for and saved and turn you into a rent-paying wage slave with no savings and no assets. Data is power. When money is only data – whoever controls the server – controls you and your life. Technologies for collecting, mining, and using data are now so cheap that even the totally impoverished nation of Somalia has turned into the model of just this sort of cashless society. The goal of the global banking aristocracy and their corrupt partners in various governments around the world – is to turn every nation on Earth, into a slave-state modelled on present-day Somalia—which has become their beta-test for global cashless debt slavery. The greatest risk posed by a purely digital money system will be the massive concentration of financial power that will be wielded by the cancerous partnership between the government and The Federal Reserve. The abuses and conflicts of interest that will certainly ensue will make the housing bubble and consequent “financial crisis” seem like an irrelevant speed bump. The Hidden Agenda of Davos — 2016 Each year, there is an annual World Economic Forum meeting in Davos, Switzerland. Leaders in business, government, and media attend to discuss the big economic issues of the day. Several contrarian economists have alleged that 2016’s event, which took place from January 17th to the 20th, included a secret meeting which took place during the conference behind the scenes. Immediately after the conference, there was a massive push to accelerate the elimination of cash, starting with high-denomination currency notes. A flood of articles from The New York Times, The Economist, Zero Hedge, and other publications mentioned this. A few days after the Davos Forum, the head of the Japanese central bank implemented negative interest rates for the first time in history. This was after he repeatedly denied that he would ever implement negative rates. Perhaps something said during Davos influenced his decision. After the conference, the CEOs of Deutsche Bank and Norway’s largest bank both called for the elimination of cash. Bloomberg published a piece called "Bring on the Cashless Future." Financial Times published a similar article. Shortly afterward, Harvard University published a paper espousing the need to eliminate high-value paper currencies, like the $100 bill and the €500 note. All of these events took place within the 6 weeks following the Davos meeting putting negative interest rates and the war on cash into overdrive. Here in the US, the Fed has printed trillions of dollars and has run out of policy tools with which to continue propping up their phony fiat money system. Interest rates are zero and soon will have to go negative in an effort to continue artificially stimulating the consumption economy. This will be impossible without banning cash. To go cashless, the Fed will have to come up with a new “currency.” It will be an electronic currency or “Fed-coin” whose purpose will be to trap all savings in the banking system. It will be the ultimate wealth confiscation and control tool. Moving to the Cashless society will be a turning point in Global history, the unintended consequences of which will be devastating to the middle class, and worse—will be irreversible. What Is the Link Between Negative Interest Rates and The War on Cash? With negative interest rates, most people will take their money out of the bank and put it under a mattress rather than suffer having to pay a penalty or a tax on saving money. The economic central planners know this, and have therefore accelerated their war on cash, along with the spread of negative interest rates around the world. I’ve already pointed out that there is not a large volume of actual paper cash residing in banks. Since fractional reserve lending has allowed banks to loan the same money to hundreds of different borrowers, most of the “money” exists as digital bytes on a computer. If people start pulling paper money out of the banks en masse, it won't take much to collapse the entire system. They want to impose the cashless society onto the people before most realize and understand the realities of this situation and start a run on the banks before they are ready. Implementing it will take time, so their solution is to make accessing cash increasingly more difficult, and in some cases, illegal. In France, for example, it’s now illegal to do cash transactions over €1,000 without documenting it properly. That keeps cash in the banking systems. That makes the banks happy because if you are prohibited from withdrawing your cash, there can’t be a bank run. The cashless society is the IRS's dream come true: total knowledge of, and control over, the finances of every single American. — Former Congressman Dr. Ron Paul Fellow citizens—the war on cash is a war against you—against your very freedom. Unless you reject this push toward the cashless society with every fiber of your being — you’d better Pucker Up — because The Worst is Yet to Come — courtesy of the criminals you have embraced as your “leaders.” Accepting such a system is tantamount to deliberately relegating your children and all future generations, to inescapable servitude, bound and subjugated to the sociopaths you have allowed to take-over your government and banking institutions. Economic activity among humanity involves consumption of resources. It is the overconsumption of resources, and the overproduction of waste that leads to environmental destruction. Therefore, humans must of their own volition live, act, and transact, within their means. They must not be coerced into overconsumption.

However, we are a complex society of specialization. For example, we have farmers specialized in dairy production and mechanical experts specialized in manufacturing agricultural machinery. The two need each other. Neither can do the work of the other and both produce far more of their respective products than each needs as an individual for himself and his family. They are therefore able to trade the excess they produce in return for that which they need. Therefore, a balance of trade is required among all of humanity in order to provide sustainability within a complex society of specialization. Otherwise, we would be relegated to return to a hunter-gatherer status as a means to attain sustainability. Furthermore, in order to deal with one another on a basis of ethics, morality and fairness (without the use of force or coercion) humans must be able to trade economically through a medium of exchange that represents a fair and equivalent value in all respective transactions. The use of barter for voluntary exchange is moral and fair. Barter may be used at any time by mutual agreement of the parties involved, but it is not practical as a means of transacting among the larger society for numerous obvious reasons. As I pointed out in the example of the dairy farmer and tractor manufacturer, the use of money as a medium of exchange in any fair and just economic transaction requires it to be sound money. It is a basic fact of economics, that when the money itself can spoil (just as milk or any perishable commodity can), it must be spent more quickly in order to exchange it for other economic value—before it loses it purchasing power. Examples of "spoilage" in money include - inflation, and deliberate devaluation of the currency. These are features solely of FIAT money - and are a consequence of deficit and "stimulus" spending by the government. "Stimulus" comes from the Keynesian theory that frivolous government spending - on anything - especially when it's unproductive - will lead to economic "growth." But their version of "growth" - is growth in consumption (we will revisit this idea again later). This leads directly to overconsumption. A sound money system (precious metal standard) prevents any actor in the economy from deficit spending - since you cannot simply print more money to cover your debt - which is why governments HATE sound money. But such a system FORCES every actor in the economy - especially governments - to live within their means. It follows then that the basis of environmental sustainability is the use of sound money, while the basis for unsustainability and overconsumption is the opposite—the use of unsound or fiat money. It has been shown that the main purpose of sound or honest money is to provide all three properties required of money: 1) medium of exchange; 2) unit of account; and 3) a sustainable store of value. Fiat, on the other hand, cannot serve as a reliable store of value, and only serves as a medium of exchange. Fiat has features however, which enable it to be used for other purposes – purposes for which sound money cannot be used. One of these is fiat’s ability to be used to distort demand among the members of society. The ability to create an infinite amount of money leads to the illusion of infinite resources and therefore generates infinite (perpetually increasing) demand. This enables a continual expansion of consumption—an unsustainable condition in nature. It also enables the creator of that money (when issued as debt with interest) to target specific markets for increases in consumption, while ignoring other market sectors (in order to pervert the natural forces of supply and demand among the larger society). This allows them to create market-specific bubbles (inflations) at their political whim. Politicians use this as a ruse to lay claim that they are shepherding a growing economy, which is a fallacy—growth in consumption is not real economic growth because it is unsustainable. When something has been consumed … it is gone. To grow this kind of economy requires consuming more, and more, and more … forever. Fiat can be used to coerce (or more accurately to delude) the population into believing that through debt expansion they have the ability to consume more than they would otherwise. This drives people across all of society to make economic transactions they would not otherwise have made with sound money – which cannot be created out of thin air. Fiat money expansion encourages people to over-consume, while sound money’s stability encourages people to be frugal, to save, and to only spend their money judiciously. Fiat money is the fundamental basis for an unsustainable economic model. Sound money is the opposite. Overconsumption is the basis for environmental unsustainability. When people over-consume, they also over-pollute. These facts lead to a singular conclusion. For a free, fair, and just society to live sustainably within Earth’s finite environment, we must base our economic model on a system of exchange that inherently demands self-discipline—one that requires all members of society, especially those with political power – to live within their means. To have one part of humanity empowered with the ability to impose their will on another part of humanity opens the door to corruption and abuse of power. Sound money is self-regulating. It precludes the abuse of political power by an arbitrary body authorized to create money from nothing. Sound money cannot be inflated to artificially expand demand and therefore overconsumption. It cannot be used by one part of humanity to manipulate the purchasing decisions of another part of humanity. By its very nature, sound money imparts fiscal discipline across the entire economy and it precludes over-consumptive behavior by every individual, group, institution, and unaccountable government. Fiat on the other hand provides exactly the opposite – a medium of exchange that can be manipulated and used by one part of humanity to profit from the unbridled consumption carried out by another part of humanity. It leads to incalculable cost in terms of unsustainable depletion of our natural resources, and generation of waste and pollution in excess of nature’s ability to process it. The basis of natural law which demands the exclusive use of sound money among our society—as a means to protect the integrity of all transactions and the sustainability of our resources—was given by the original United States Constitution. Article 1, Section 8 guaranteed our nation a system of sound money based on the gold and silver standard. The US Constitution, in terms of its original meaning and intent, was the first (and remains the only) governing document ever drafted which provides this economic recipe for humanity to coexist peacefully, sustainably, fairly, ethically, and in accordance with the laws of nature. Indeed, the framers wrote voluminously about their intent to base The Constitution upon Natural Law. This was discussed extensively by their intellectual and philosophical mentors such as Adam Smith and John Locke, and goes all the way back to the Magna Carte. It was the Federal Reserve Act of 1913 and the sixteenth amendment that acted to subvert this basic principle. Their sole purpose was to create an economic model whose moral basis is diametrically opposed to the Constitution’s original intent. Their intent was to enable our currently unsustainable system of consumption-based illusory growth through fiat money—solely for the benefit of the money printers. It is they who are destroying this planet as any parasite that slowly consumes its host, until nothing is left but a bleached skeleton laying on a barren desert. Is this what "we the people" wish for this once-great country? Make no mistake about it. Environmentalism is a political movement--nothing more. Politics is the use of force and coercion by one group of men over another. Conservationism on the other hand, is the basis for acting to preserve our environment and natural world for posterity, and for future generations—not the basis for political power, prestige, or personal gain. We have seen how this country’s politicians almost universally declare themselves as environmentalists, while at the same time they consistently act to preserve our corrupt fiat monetary system whose main purpose is to enable overconsumption (fiscal stimulus and deficit spending). Political environmentalists are therefore the worst kind of hypocrites. Our fiat monetary model is based on Marxism and on the Keynesian notion of digging holes in the ground in order to fill them in again, as a means to create jobs and economic growth. It enables endless foreign interventionism, wars, debt expansion, mal-investment, all of which lead directly to the over-use and destruction of our natural resources. This does not enable the creation of sustainable economic value and it is absolutely incompatible with a policy of conservationism. Fiat money can simply be re-printed if it is lost, mal-invested, or misspent. Money that you can print out of thin air can be spent frivolously, without a judicious discipline in its employment as capital. It is therefore the basis of a society bent on over-consuming until we are left with an over-polluted, unsustainable, unlivable planet covered with trash dumps, bomb craters, and other useless holes in the ground—courtesy of John Maynard Keynes and Karl Marx. Fiat money is the system we are currently living under. Economic activity is not the same as economic growth. Real growth—sustainable value creation—comes from investment, savings, and creating real lasting value for all of humanity. The basis for this is a system of money that has shelf-life, and for which the risk of loss is real. That kind of money demands that it is employed judiciously in terms of investment in production because if it is mal-invested … it is wasted, along with the resources which were consumed in order to mine for, and mint it into existence. This is the main distinction which escapes the understanding of most people. Marxist (and Keynesian) FIAT money that today's central banks can create in the trillions - with nothing more than a keystroke on a computer - has no intrinsic value - for obvious reasons. The idea that creating it and then injecting it into the economy to "stimulate" demand that didn't before exist - is an absurd perversion of the economy. An asset-based money on the other hand - such as gold or silver coin - can only come into being when REAL - already existing economic demand requires that new money be created. And then, the only way to create it - is to trade labor in the act of mining for and then minting those coins. This is what gives sound money its intrinsic value. Labor has already been traded in the act of its creation - giving it intrinsic value. It is why that kind of money is called "honest" money, or "sound" money—the system the US Government abandoned in 1913 - in direct violation of the US Constitution. Most politicians label themselves as "environmentalists," while at the same time supporting and defending our Unconstitutional economic model - as a means to expand their power - through deficit spending. Environmentalists are out to enrich themselves, by co-opting the otherwise virtuous and honorable movement of conservationism--mainly to gain political power. In case you haven't yet figured it out - the political class - all of whom call themselves "environmentalists," are in fact hypocrites, liars, thieves, and degenerates. True conservationists are out to protect Mother-Earth. Doing so requires a devotion to TRUTH. When one misrepresents the problems of our society as being the opposite of their true nature, the wrong solutions to those problems will ALWAYS be applied. Environmentalists are after political power. They are hypocrites whose actions are as destructive to our environment as any rampantly polluting industrial chemical company - perhaps more-so; for they steadfastly support the very economic model that enables such institutions and encourages their irresponsible largess. True conservationists could achieve their ends far more effectively and quickly by pushing for a restoration of sound money—the precious-metal standard—as our monetary system. This therefore requires a restoration of The United States Constitution in terms of its original meaning and intent. These are the true bases for a sustainable and prosperous standard of living for all of mankind, while preserving and protecting our natural environment. In fact, restoring the Constitution, and our system of sound money are the only chance humanity has to save this planet from environmental annihilation. And Time is Running Out. Two weeks ago, on June 28, 2015, banks in Greece were forced to shut their doors.